Banking on the Cloud: Transforming Finance with Cloud Computing is revolutionizing the way financial services are delivered and managed. With the increasing reliance on technology in the banking industry, the cloud has emerged as a game-changer, offering numerous benefits and transforming the way banking operations are conducted.

The adoption of cloud computing in banking has significantly increased in recent years. This shift has allowed banks to harness the power of scalable and flexible cloud-based solutions, enabling more efficient operations, enhanced customer experiences, and improved cybersecurity measures. According to a report, the global cloud banking market is projected to reach $60.73 billion by 2025, demonstrating the increasing importance and impact of cloud computing in the financial sector.

Banking on the Cloud: The Future of Financial Services

Cloud computing has revolutionized numerous industries by offering scalable and cost-effective solutions, and the financial services sector is no exception. With the ability to store and access data remotely, process large volumes of transactions, and enable real-time collaboration, cloud technology has transformed the way banking and finance professionals work and serve their clients. Banking on the cloud has become a strategic imperative for financial institutions looking to enhance their operational efficiency, agility, and customer experience.

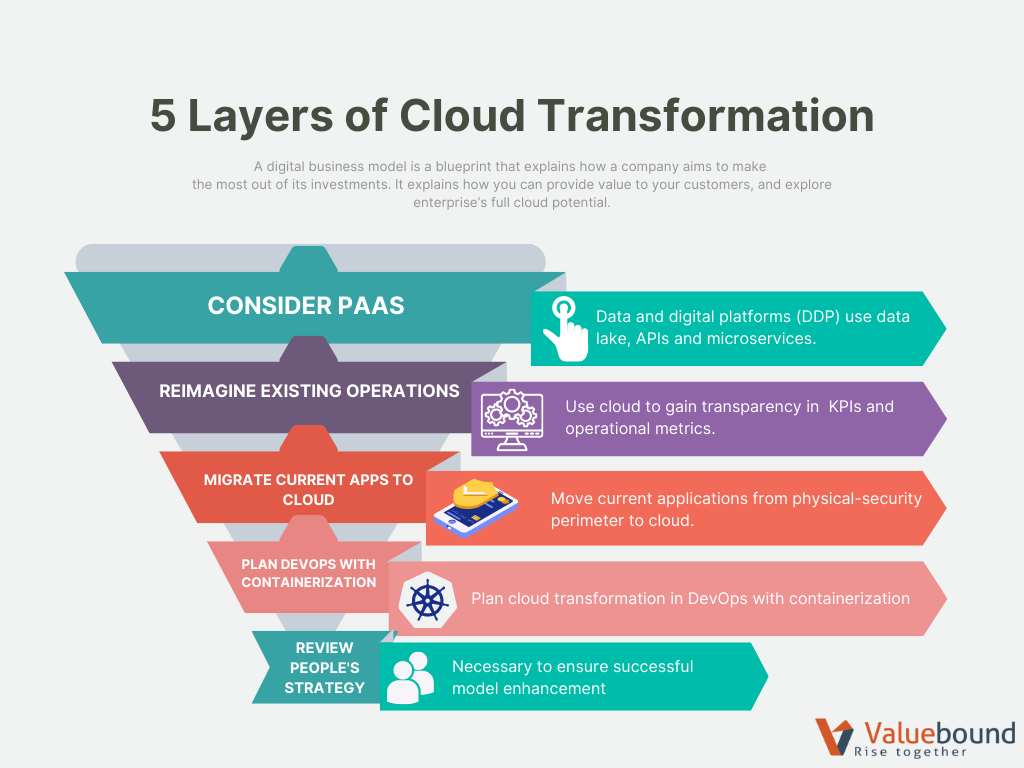

Today, financial institutions are leveraging the power of the cloud to streamline their processes, improve accessibility, and reduce costs. By shifting their operations to cloud-based platforms, banks can benefit from increased scalability, flexibility, and security. Cloud computing offers a wide range of services, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). These services enable banks to eliminate the need for on-site hardware and software infrastructure, providing a more cost-effective and scalable solution.

Furthermore, leveraging the cloud allows banks to access data and applications from anywhere, at any time, using any device. This level of accessibility enhances collaboration among team members and allows for more efficient decision-making processes. With cloud-based technologies, banks can also integrate different systems and applications, creating a seamless workflow and ensuring data accuracy and consistency.

Enhanced Security and Compliance

While security concerns have historically hindered the adoption of cloud computing in the finance industry, the technology has evolved significantly in recent years. Cloud service providers now offer robust security measures, such as encryption, firewalls, and intrusion detection systems, to safeguard sensitive financial data. Additionally, data stored in the cloud is typically backed up and replicated across multiple locations, minimizing the risk of data loss or downtime.

The cloud also enables financial institutions to comply with strict regulatory requirements. Cloud service providers often have extensive experience working with regulatory bodies and can help banks meet compliance standards, such as the General Data Protection Regulation (GDPR) or the Payment Card Industry Data Security Standard (PCI DSS). Compliance with these standards is crucial for financial institutions to protect customer data and maintain the trust of their clients.

Moreover, cloud platforms can feature advanced identity and access management systems, allowing banks to control and restrict user access to sensitive data. The ability to monitor user activities, enforce strong authentication protocols, and track data access provides an additional layer of security and mitigates the risks associated with unauthorized data breaches or insider threats.

Improved Cost Efficiency

Moving banking operations to the cloud offers significant cost savings for financial institutions. Traditional banking systems often require large investments in hardware infrastructure, data centers, and IT staff. On the other hand, cloud-based solutions eliminate the need for costly on-site infrastructure, as the cloud service provider manages and maintains the underlying hardware and software.

Cloud computing also enables banks to scale their operations on-demand, allowing them to pay only for the resources they use. This pay-as-you-go model eliminates the need for upfront investments in infrastructure, making it more cost-effective for financial institutions of all sizes. Additionally, cloud platforms offer automated backups, system updates, and maintenance, reducing the burden on banks’ IT departments and freeing up resources for strategic initiatives.

Furthermore, cloud computing can help financial institutions optimize their operational efficiency. By automating repetitive tasks and streamlining workflows, banks can improve process efficiency, reduce errors, and enhance overall productivity. In the competitive world of finance, efficiency gains can make a significant difference, allowing banks to deliver faster and better services to their clients.

Scalability and Business Agility

One of the key advantages of banking on the cloud is the scalability it offers. Financial institutions frequently experience fluctuations in workload, particularly during peak periods or when launching new products and services. Cloud computing allows banks to scale their operations up or down on-demand, without the need for significant hardware investments or disruptions to their existing systems.

Furthermore, cloud-based solutions enable banks to quickly deploy new applications or services, reducing time-to-market and accelerating innovation. With the cloud, banks can experiment with new technologies, such as machine learning and artificial intelligence, to develop personalized customer experiences, enhance risk management capabilities, and improve fraud detection systems. This agility and ability to adapt to changing market conditions are critical for financial institutions to remain competitive in the digital era.

Additionally, the cloud provides banks with the flexibility to implement new business models and expand into new markets. As financial services become increasingly digital, cloud-based platforms offer the ideal infrastructure for banks to offer innovative products and services, such as digital banking, mobile payments, and robo-advisory solutions. This flexibility to adapt and evolve business models positions banks for long-term success in an ever-changing industry.

Cloud-Based Data Analytics and Machine Learning

The vast amount of data generated by financial transactions and customer interactions presents valuable opportunities for banks to gain insights and drive business growth. Cloud computing provides the necessary infrastructure for banks to store, analyze, and derive actionable insights from their data using advanced analytics and machine learning algorithms.

With cloud-based data analytics tools, banks can identify patterns, trends, and anomalies in their data, enabling them to make data-driven decisions, detect fraud, and manage risks more effectively. Moreover, cloud platforms offer the computational power required to process large datasets and run complex algorithms, empowering banks to develop predictive models, optimize portfolios, and personalize customer experiences.

Machine learning, a subset of artificial intelligence, allows banks to automate decision-making processes and enhance their risk management practices. By analyzing historical data and detecting patterns, machine learning algorithms can predict creditworthiness, detect suspicious transactions, and identify potential compliance violations. These capabilities help banks minimize risks, streamline operations, and ensure regulatory compliance.

Improved Customer Experience

The cloud plays a vital role in improving the overall customer experience for banking and financial services. With cloud-based platforms, banks can offer their clients access to their accounts and services through a variety of digital channels, including mobile apps and online portals. This anytime, anywhere access allows customers to manage their finances, make transactions, and access support services on their terms.

The cloud also enables banks to leverage data to deliver personalized experiences to their customers. By analyzing customer behavior, preferences, and transaction history, banks can offer tailored product recommendations, personalized marketing campaigns, and proactive support. These personalized experiences not only meet customer expectations but also drive customer loyalty and retention.

Additionally, the cloud enables seamless integration of banking services with third-party applications and platforms, creating a more connected ecosystem of financial services. Through open APIs (Application Programming Interfaces), banks can partner with fintech companies and offer their customers a wide range of innovative services, such as budgeting apps, investment platforms, and digital wallets. This ecosystem approach further enhances the customer experience and positions banks as comprehensive financial service providers.

The Road Ahead: Embracing Cloud Technology in Finance

As the financial services industry continues to evolve and adapt to changing customer expectations and market dynamics, cloud computing will play an increasingly pivotal role in shaping the future of banking. By leveraging the cloud, financial institutions can gain a competitive edge by improving operational efficiency, enhancing security and compliance, and delivering superior customer experiences.

However, embracing cloud technology requires careful planning and execution. Financial institutions must ensure they choose reliable cloud service providers that meet stringent security and compliance requirements. Additionally, banks should consider the integration capabilities, scalability, and flexibility offered by cloud platforms to support their long-term business goals.

The journey of banking on the cloud is not without challenges, particularly related to data privacy and cybersecurity. Financial institutions must work closely with their technology partners and regulatory bodies to address these concerns and implement robust governance frameworks.

In summary, banking on the cloud offers numerous advantages for financial institutions, including enhanced security, cost efficiency, scalability, and the ability to leverage data analytics and machine learning. By embracing cloud technology, banks can transform their operations, stay ahead of the competition, and deliver innovative and customer-centric services. The future of finance is undoubtedly in the cloud, and financial institutions must adapt and embrace cloud computing to thrive in the digital age.

| Cloud Benefits for Banks: |

| Enhanced security and compliance |

| Improved cost efficiency |

| Scalability and business agility |

| Cloud-based data analytics and machine learning |

| Improved customer experience |

Key Takeaways: Banking on the Cloud: Transforming Finance with Cloud Computing

- Cloud computing is revolutionizing the finance industry by providing secure and flexible solutions for banks and financial institutions.

- With cloud computing, banks can reduce infrastructure costs, improve efficiency, and enhance customer experiences.

- The cloud allows banks to easily scale their operations, access advanced analytics capabilities, and leverage artificial intelligence for better decision-making.

- Cloud computing enables banks to store and process massive amounts of data securely, ensuring regulatory compliance and data protection.

- Adopting cloud computing can help banks stay competitive in a rapidly evolving digital landscape and drive innovation in financial services.

Cloud computing is transforming the banking industry, offering numerous benefits for financial institutions and customers alike. The cloud enables banks to store and access large amounts of data securely, providing faster and more efficient services.

By utilizing the cloud, banks can enhance their operations, streamline processes, and improve customer experience. With increased scalability and flexibility, banks can adapt to changing demands and offer innovative solutions. The cloud also helps in reducing costs and enhancing security measures, ensuring the protection of sensitive financial information.

Overall, cloud computing is revolutionizing the finance sector, enabling banks to stay competitive in a rapidly evolving digital landscape.